Retirement saving doesn't generate a lot of excitement with teenagers. However, since I am focusing on the wise and creative use of money, I can't think of anything better than a Roth IRA, for those who qualify. This year and next one can put up to $4000 in a Roth IRA if you're under 50.

focusing on the wise and creative use of money, I can't think of anything better than a Roth IRA, for those who qualify. This year and next one can put up to $4000 in a Roth IRA if you're under 50.

If you are a young person with earned income, or a parent/grandparent of one, funding a Roth IRA to the max is an amazing investment. Of course it presumes privilege to be able to invest the money and not spend it. Roth IRA contribution $ are taxed the year the money is earned, at a relatively low rate for young earners (we're probably talking part time, fill-in work, not full-time employment), or not taxed at all if the worker is low-income enough, and invested tax free. [Of course you need to check with an expert.] If you earn just a few thousand dollars, you can basically put it all away, tax free, if you have the means to do so.

Look at the magic of compounding. If an 18-year-old puts in $1000 (sounds like someone who worked at a summer camp, maybe?!) in this year, at 10% growth, it will be worth $106,000 by age 67. Even if the return is more modest, it is still whopping compared to typical investments. The trick is to do this as early in life as possible.

If you are a young person whose parents or grandparents have disposable income and you do not, this is a very wise thing to ask for help with; think of it is an earnings match. If you are a parent or grandparent of a kids at this stage, offering to do this for them is an incredibly smart financial move. I t won't cost you much, and they will eventually clear a 1 to 100 return on this investment!

t won't cost you much, and they will eventually clear a 1 to 100 return on this investment!

Hint to young persons: older folks might not come through with money for something consumable, but I think average parents or grandparents who had not thought of this themselves would be impressed with their kid/grandkid suggesting it. What a gift! And of course they are rewarding earned income. You cannot qualify for this unless you've actually earned money. So parents/grandparents are rewarding industriousness. This can be arranged up until April 17, 2007.

Wednesday, March 14, 2007

Gift Registry for Retirement: Suggestions

Posted by

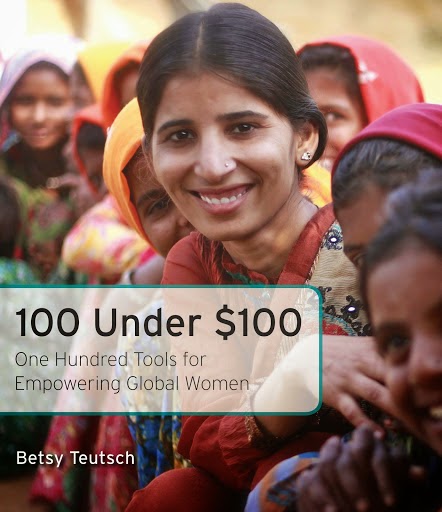

Betsy Teutsch

at

1:29 PM

![]()

Labels: children's financial education, intergenerational wealth transfer/ inheritances, privilege

Subscribe to:

Post Comments (Atom)

2 comments:

Not sure how roth IRA's work because I live in Australia. But as an economics student I have a problem with people not fixing this stuff for inflation. If you do it's actually more like $27500 at the end of the 49 years.

The only reason I mention this is because it's extremely important for people to understand the concept of inflation. It'll make them better savers in the long run. (I.e if a normal bank gives you 1% and inflation is 2% you are actually loosing money on a daily basis by having the money in that account and not in a higher interest account).

Also it's worth looking for something which gives you multiple compounding (i.e monthly) this would bring your figure to $131590, an extra $25000 or so.(and mine to $30570 an extra $2500) But as I said, I have little idea how IRA's work and if its fixed interest at 10% that's a fantastic deal.

Thanks, William. There are many different aspects to the complex calculations of longterm investment. The main advantage of putting away money in an IRA early is not that the rate of return is any higher, it's just that it's away for longer, so you have more time for the $ to compound. Also, you pay tax on the earnings before you put it in, presumably at a lower rate. The IRA is then tax free when you take the money out,upon retirement, so that's a huge benefit.

Post a Comment